does tennessee have estate or inheritance tax

Inheritance taxes in Tennessee There are NO Tennessee Inheritance Tax. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts.

An Overview Of Tennessee Trust Law

If the total Estate asset property cash.

. Inheritance Tax in Tennessee There are NO Tennessee Inheritance Tax. Tennessee does not have an estate tax. Tennessee is an inheritance tax and estate tax-free state.

It is one of 38 states with no estate tax. The top estate tax rate is 16. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state.

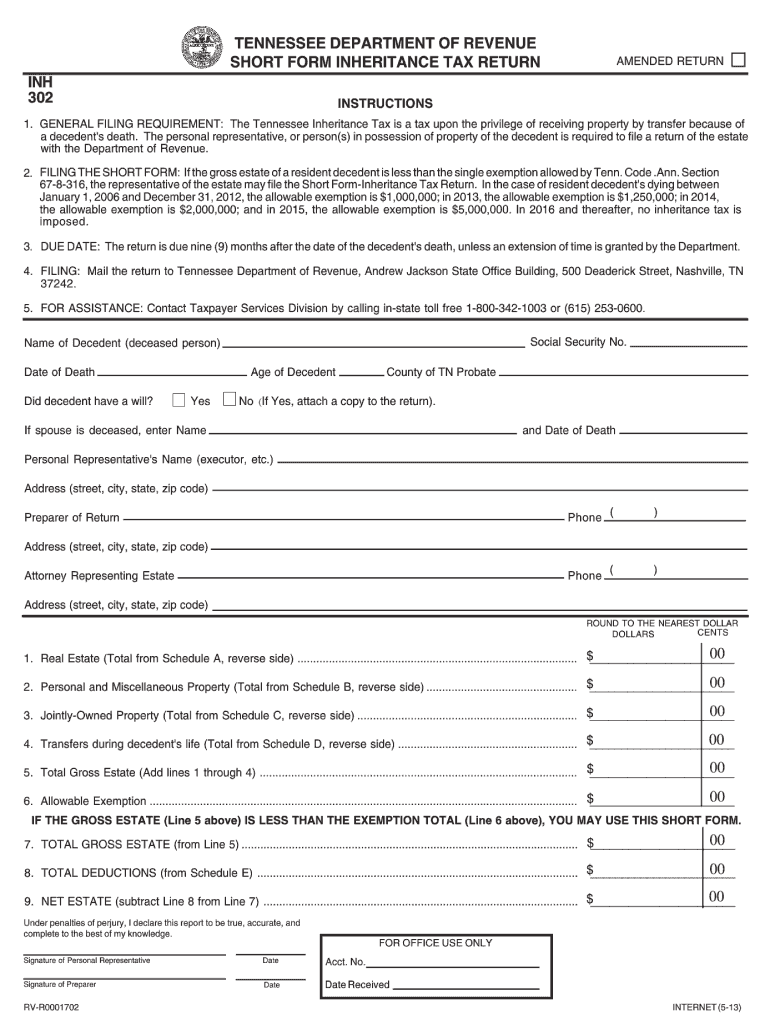

Tennessees tax on alcoholic beverages is 440 per gallon of spirits and 121 per gallon of wine. According to the Tennessee Department of Revenue. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax.

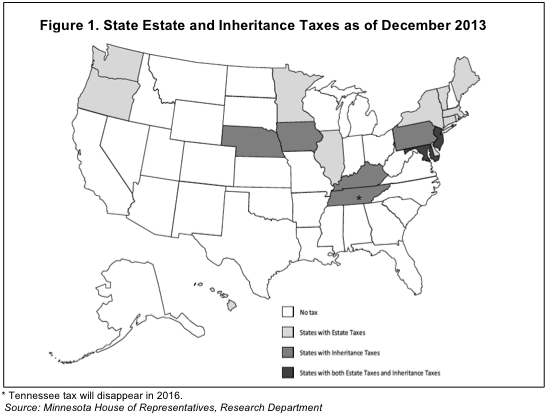

Twelve states and the District of. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional state estate tax or state inheritance tax. Tennessee has no inheritance tax and its estate tax expired in 2016.

Tennessee is an inheritance tax and estate tax-free state. The State of Florida does not have an inheritance tax or an estate tax. Yet some estates may have to pay a federal.

All inheritance are exempt in the State of Tennessee. The taxes that other states. Tennessee is not impose an estate tax.

Until this estate tax is. This is great news for residence. Those who handle your estate following your death though do have some other tax returns to take care.

Yet some estates may have to pay a federal estate tax. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. Up to 25 cash back Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million.

Indiana Ohio and North Carolina had estate taxes but they were repealed in 2013. Estate and Inheritance Taxes. The exemption is 117.

Today Virginia no longer has an estate tax or inheritance tax. Tennessee Texas Utah Virginia West Virginia Wisconsin Wyoming States That Have Estate or Inheritance Taxes This leaves 17 states plus the District of Columbia that. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million.

For the purposes of this post we are going to address the last question about Tennessees inheritance tax. In fact it doesnt matter the size of your estate there will be no state level tax assessed.

Tennessee Inheritance Tax Repealed It S Time For An Estate Planning Review

Affidavit To Waive Filing Of Tennessee Inheritance Tax Return 007 Pdf Fpdf Doc

North Carolina S Estate Tax Dying Out Estate And Elder Law Blog Estate And Elder Law Lexisnexis Legal Newsroom

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

A Guide To Tennessee Inheritance And Estate Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tennessee Tax Resolution Options For Back Taxes Owed

State Estate And Inheritance Taxes Itep

State Estate And Inheritance Taxes In 2014 Tax Foundation

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

New York S Death Tax The Case For Killing It Empire Center For Public Policy

State Death Tax Is A Killer The Heritage Foundation

Does Kansas Charge An Inheritance Tax

Order Waiving Filing Of Tennessee Inheritance Tax Return 073 Pdf Fpdf Doc Docx

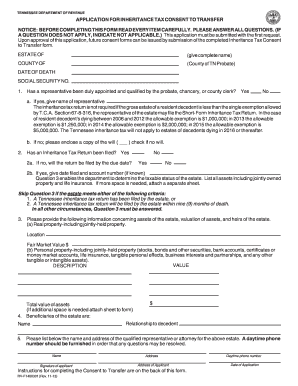

Inheritance Tax Waiver Form Tennessee Fill Out And Sign Printable Pdf Template Signnow

Form 302 Tn Inheritance Tax 2013 Fill Out Sign Online Dochub

Big News For 2012 Tennessee Repeals Gift Phases Out Inheritance Tax Elder Law Of East Tennessee